In the spirit of “don’t let good writing go to waste,” this is a roundup of some of my recent social media comments. I’m one of those people who likes to take my free education to a number of left-leaning social media sites, so my readers may not see this.

This week I’m splitting this feature in half, with one half tonight and the other half on Tuesday night after I stamp my thoughts on the Wicomico Lincoln Day Dinner tomorrow.

Regarding a letter to the Daily Times chastising Andy Harris’s health care votes:

If the writer is a member of “Regressive Maryland” (as I like to call them) it’s doubtful she has ever voted for Harris anyway. So she’ll be disappointed again when Andy gets his 60% or more of the vote in our nicely gerrymandered Republican district.

In a nutshell, instead of encouraging people to be insured by perhaps making the premiums fully deductible or allowing standard, basic policies to be sold nationwide, the government decided to make it mandatory to have insurance. And guess what? If you are forced to be in a market, what do you think the prices will do?

The federal government needs to be out of health insurance – stat.

I have a lot of fun writing responses to the House Minority Whip Steny Hoyer when he gets his inane commentaries up – like this one in the wake of the Las Vegas shooting.

I’ll out myself as a so-called “right winger” (I prefer the term Constitutional, liberty-minded conservative myself) but here’s a pro tip: arguing in ALL CAPS isn’t getting the job done.

The reason Steny’s stayed in office so long is the way his district is gerrymandered to include a large chunk of PG County. That saved his bacon early on and subsequent redistricting (as well as the growth of Charles County as a bedroom suburb of PG County) keep him there. There was once a proposal to split the Eastern Shore up and put the lower half in his district, but I’m sure he wanted no part of that. We don’t think he makes a whole lot of sense.

Now, as for a time to debate gun control: the left-wing malcontents couldn’t even wait for the full accounting of dead and wounded (or all the facts surrounding this incident) until they were screaming about gun control. But what if he had driven a truck into the crowd, or planted a shrapnel bomb? Would you be caterwauling for truck control or nail control?

Simply put, a gun is a tool and its usual job is protecting the bearer. Sometimes it’s used for the wrong purpose, as it was this time. So in my view the discussion shouldn’t be about guns, but about God. What drives a man to violate the basic commandment of “thou shalt not kill” because he has a hatred for a group? Well over 90% of people who own guns have at least the basic understanding of their power and also have the sense to know right from wrong – you know, that whole “thou shalt not kill” thing?

One rumor has it that this assailant was a member of several anti-Trump online groups. I see more vitriol about our current President (a guy I didn’t vote for) than I have about the last two combined. Last time I checked, no one from that evil right wing pulled out an arsenal and tried to mow down Obama supporters in numbers like this guy did – and I’m sure it could have been done 100 or more times.

So how about we debate self-control and leave guns out of it? I can sit and stare at the whole arsenal this guy had all day, but since I would have no intention under any normal circumstance to pick it up there’s no harm done.

Or how about the Avoidable Care Act? I responded to one commenter who threw shade on the idea of selling insurance across state lines as a Republican “panacea”:

You make a fair assessment, but there is one area you’re discounting. At the time the study was done, the federal mandates of Obamacare were already being put into place, so states weren’t going to be terribly innovative about what they did. In order for something like this to work there has to be a minimum of federal regulation as well – the less, the better.

Remember, the concept of Obamacare came about at a state level and I think that is where the solutions lie. Here in Maryland we will likely always be a nanny state, so a company that wants to sell here would have to enact policies that match up to our laws. On the other hand, a state like Texas could be more lenient. Yet if someone could create the most bare-bones policy possible with a robust physician network and a la carte features (like I wouldn’t need maternity coverage but may want more enhanced mental health coverage because this government drives me crazy) they may pick up enough of a risk pool around the country to make insurance affordable. Then it would be up to consumers to demand their states give them more choice by relaxing their regulations.

Yet there could be advantages to even allowing policies to be sold across state lines – people are price-conscious. I live maybe two miles from the Delaware border so if there was a policy available there which had a network that extended here into Salisbury (very possible because we have the largest regional hospital) it would be to my advantage to do so – it’s the same reason you see all the stores that sell furniture and other portable big ticket items clustered just across the line in tax-free Delaware, and the largest Royal Farms chainwide cigarette seller being the store out in the middle of nowhere but literally 50 yards into Virginia and its 30 cent per pack tax (compared to $2 in Maryland) right on a main highway.

I agree selling across state lines isn’t a complete panacea, but it would be a useful tool in the toolbox.

Then after another comment complained about Trump opening the door for the insurance industry, Big Pharma, and doctors to raise rates I set her straight, too.

If the first word of (the writer)’s initial statement had been “Obama” that would have been solid gold truth. When people are forced to buy a product and lobbyists write the regulations, what incentive is there to “bend the cost curve”? Think of how much you pay a month for auto insurance because the state forces you to have it – the only saving grace is that they set comparatively few regulations on policies so there is competition to help give people a bit of a break.

I don’t spare our junior Senator when he plays the class envy card, either:

It seems to me cutting the brackets from 7 to 3 and eliminating a batch of deductions few people take IS simplifying the tax code. But of course any GOP plan is “tax cuts for the wealthy” to you. News flash: they pay the largest share of taxes.

Personally I think the FairTax is the best way to go but that doesn’t allow for nearly as much government modification of behavior.

After someone whined that cuts should be spread in a “more equitable manner” I added:

When you pay the most, you get the most benefit. Let’s get more numbers and throw away the class envy card, as I have.

Later on I added as a status:

Three facts for future reference when responding to Chris Van Hollen, Ben Cardin, Steny Hoyer, Allison Galbraith, etc. Per the Tax Foundation:

The share of income earned by the top 1 percent of taxpayers rose to 20.6 percent in 2014. Their share of federal individual income taxes also rose, to 39.5 percent.

In 2014, the top 50 percent of all taxpayers paid 97.3 percent of all individual income taxes while the bottom 50 percent paid the remaining 2.7 percent.

The top 1 percent paid a greater share of individual income taxes (39.5 percent) than the bottom 90 percent combined (29.1 percent).

So when they talk about “tax cuts for the wealthy” and “not paying their fair share,” well, here are the actual numbers. If you want “Atlas Shrugged” just keep raising tax rates on productive people.

You know, I can see why some of our representatives run out of patience with people. One example at a Michigan townhall meeting was made into a story by the real Faux News, the Shareblue website. So I said my piece:

Gee, were the eight people in the back who were clapping and cheering the question offended? Out of a crowd of what looked like 75 to 80 people you all could muster 10? Pretty sad.

Now instead of picking up the video halfway through like your share did, I watched the whole thing. Walberg answered the question respectfully only to be shouted down near the end because a select few didn’t like the answer.

Did he handle it well? Could have been better, but I’m not as worried about him as I am the mental state of some of those commenting here. And you may want to ask yourself regarding North Korea: who enabled them to get nukes in the first place?

For that I was accused of being an idiot who voted for him. Try again.

Sorry, I don’t live in Michigan (although I grew up close by his district – Tecumseh is maybe a half-hour from Toledo.) But yes, I have my own Congressman nowadays who’s pretty good – it’s the two lame Senators I’m stuck with that are the problems.

But again to my point: who enabled North Korea to get nukes in the first place?

You know, they never answered my question.

Okay, let me wrap up this one with something lighter. We all have opinions on baseball uniforms, so this was mine in response to a poorly written piece that I’d be ashamed to put my name on.

I don’t know which was worse…the writing, editing, or fact she could have picked another dozen as good and definitely some straight-up bad ones…Padres in brown and gold first come to mind on the bad side. On the other hand I actually liked the Seattle Pilots jersey given the style at the time. Better than what the Mariners first wore.

And maybe it’s a product of growing up in the 1970s but I was more impressed when teams actually went to the colored jerseys than when they simply swapped out the road gray for light blue. It didn’t work well for the Cardinals, Twins, Rangers, or Phillies, but a little better for the Brewers, Cubs, Blue Jays (I liked the split-letter font too) and Royals. It was so-so for the Expos and Mariners.

I will say that the Astros rainbow jerseys spawned a couple imitators from local high schools in my area, so someone liked them.

And yes, as a Tigers fan there is no beating the Olde English D as a classic.

True dat. Look for the next installment on Tuesday and I’ll pretty much be caught up.

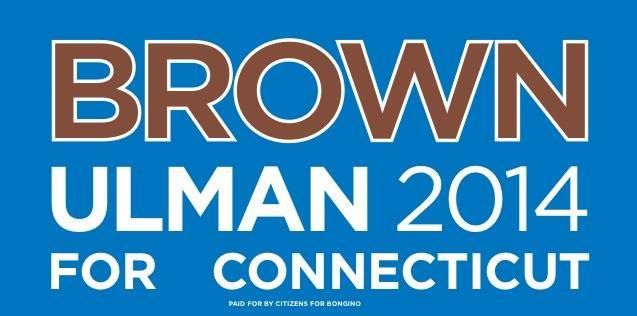

It’s unfortunate the press conference wasn’t a couple weeks earlier, because the announcement had all the makings of a great April Fool’s joke. Unfortunately, the joke has been on Maryland taxpayers so earlier today Congressional candidate Dan Bongino and gubernatorial candidates David Craig and Ron George made their endorsement of Anthony Brown for governor of the Nutmeg State, Connecticut.

It’s unfortunate the press conference wasn’t a couple weeks earlier, because the announcement had all the makings of a great April Fool’s joke. Unfortunately, the joke has been on Maryland taxpayers so earlier today Congressional candidate Dan Bongino and gubernatorial candidates David Craig and Ron George made their endorsement of Anthony Brown for governor of the Nutmeg State, Connecticut.