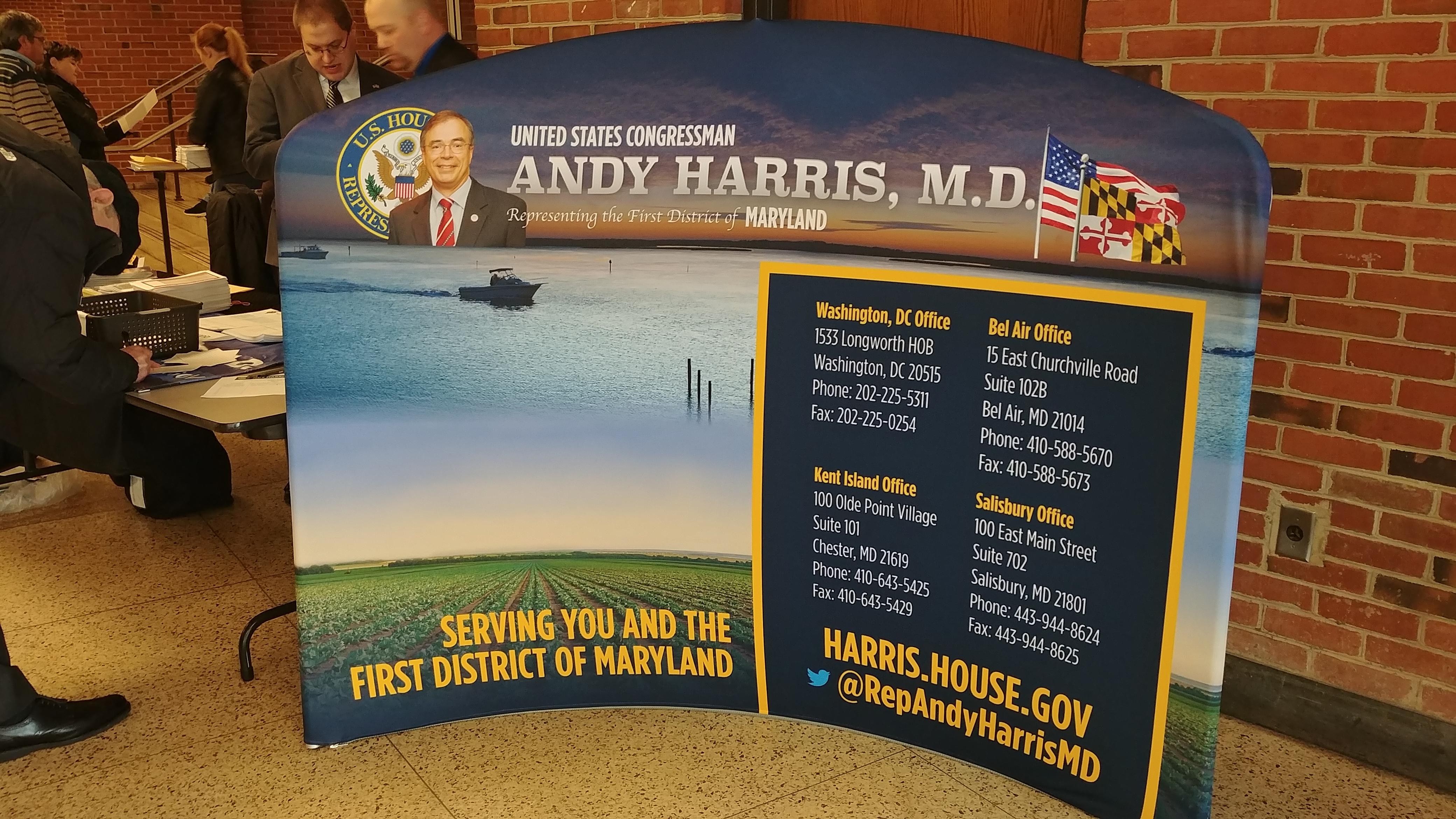

Back in March Congressman Andy Harris hosted what could be described as a contentious town hall meeting at Chesapeake College in Wye Mills. It was believed that yesterday’s event would be more of the same, but a disappointing fraction of that traveling roadshow of malcontents came down to Salisbury in their attempt to jeer, interrupt, goad, and otherwise heckle Andy Harris for the entire hour-long event.

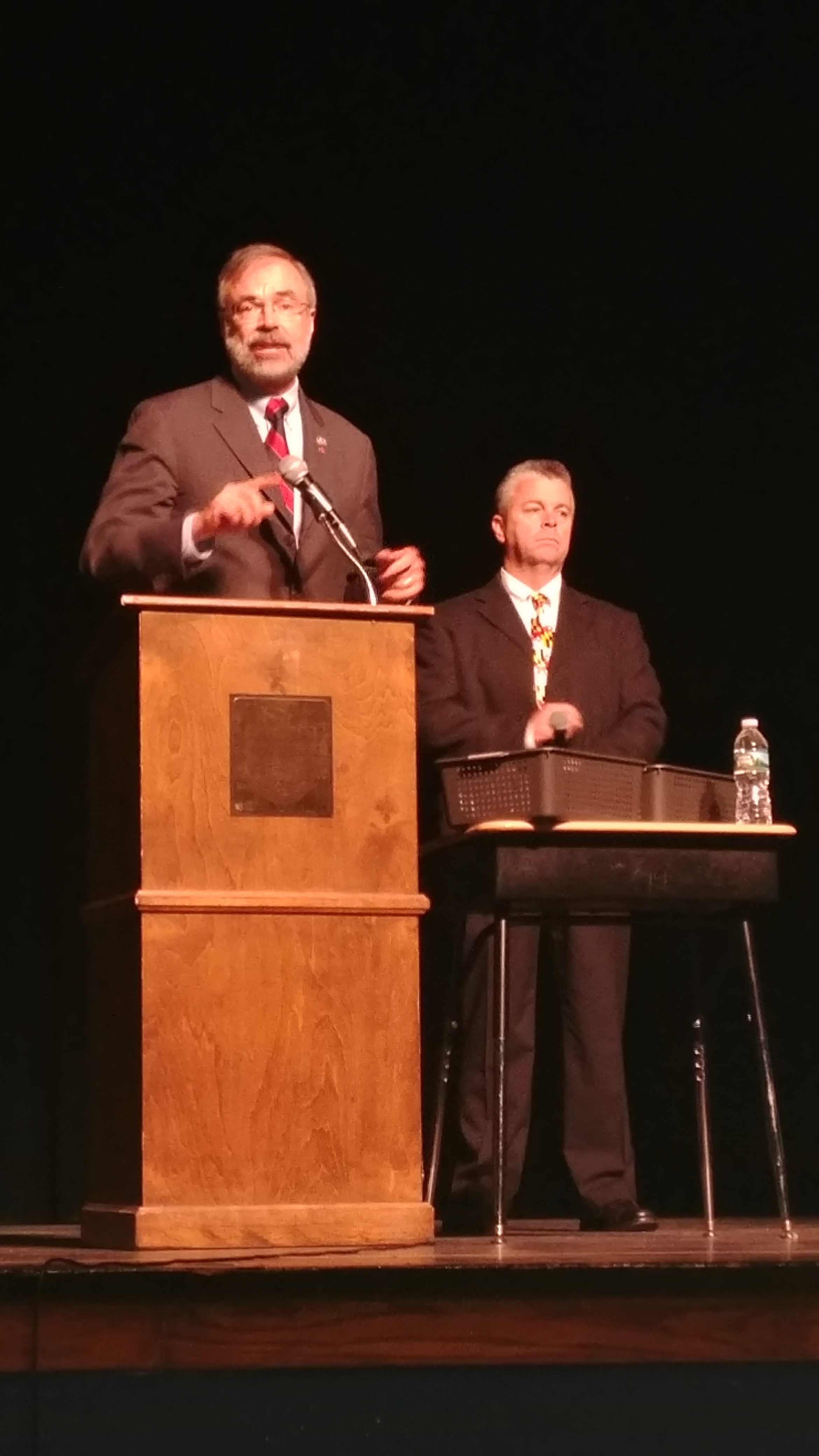

There were a couple other departures from the Wye Mills townhall, one being the choice of moderator. In this case, we had Wicomico County Sheriff Mike Lewis acting as the questioner and doing a reasonable job of keeping things in order.

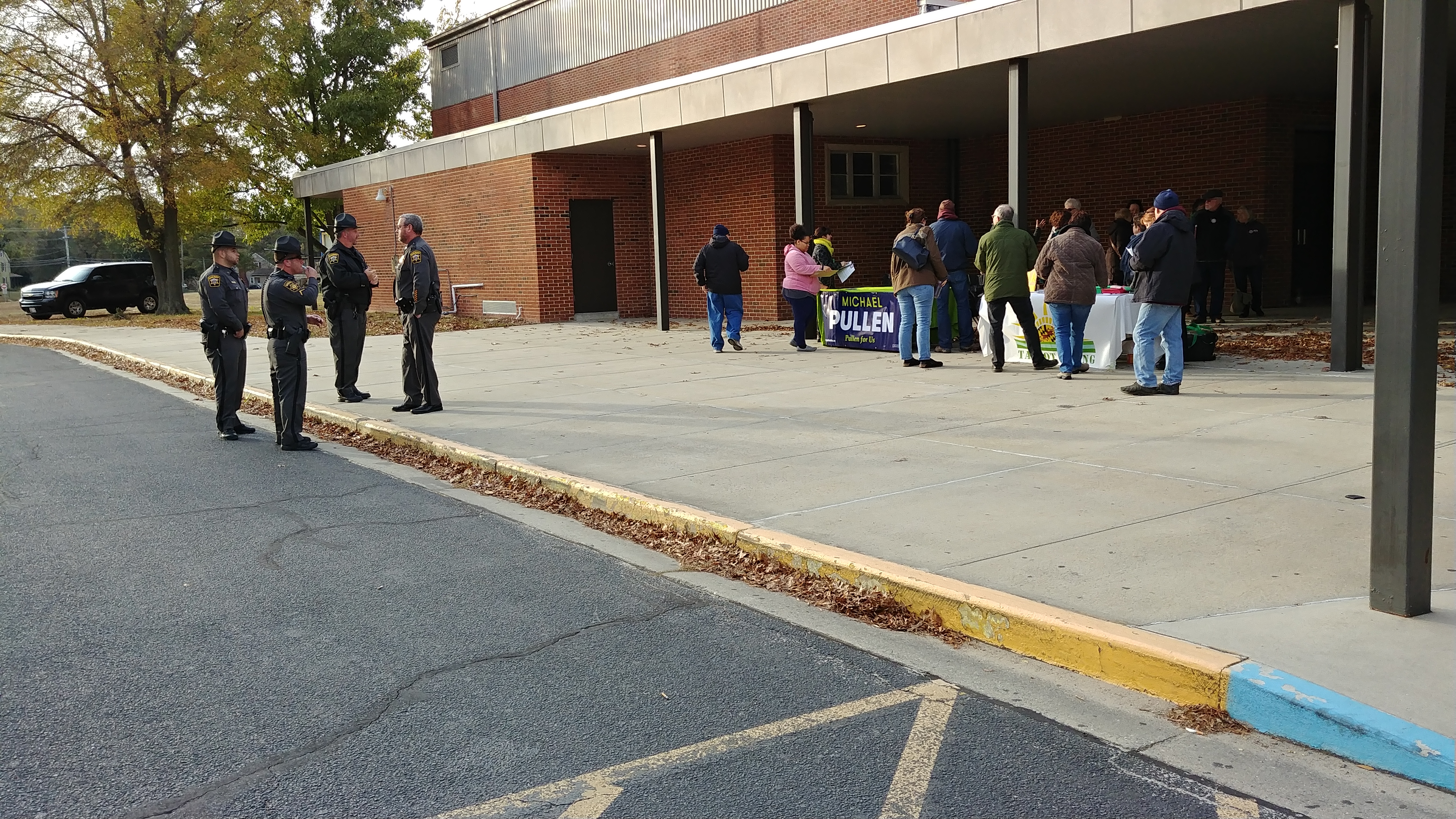

Interestingly enough, the people at these “progressive” group tables outside have our Sheriff – the same one they were castigating for his “divisive rhetoric” a few weeks ago – to thank for their continued presence there.

As one would expect, the Harris campaign wasn’t cool with the presence of these tables outside and had asked them to leave, but they were overruled by Lewis. This was an event open to the public and not a school function, Lewis told me, so as long as they did not create a disturbance or block access or egress they were free to be there. The table on the left was run by volunteers for Democratic challenger Michael Pullen and the one on the right by “nonpartisan progressive grassroots volunteer organization” Talbot Rising. The latter group was there two hours early when I arrived.

The other departure was the lack of a PowerPoint presentation to open the townhall meeting, slated for an hour but lasting a few minutes extra. Harris rolled right into the questions, which were divided into tax-related questions and everything else.

Outbursts were frequent, but Lewis only had to intercede a couple of times. There was also a staged incident where a man dressed as Rich Uncle Pennybags thanked Harris for his tax cut, with two helpers holding a fake check – all three were escorted from the premises.

Speaking of tax cuts, this was to be the main emphasis of the program. It was the part that drew the sea of red sheets from the crowd.

(By the way, there was a young man there who passed red and green sheets to everyone. I was too busy writing and trying to follow to use them much, though.)

Now I will warn you: the rapid-fire way of getting questions in, coupled with the frequent jeering interruptions from the crowd (which was closer to me than the loudspeaker was) made it tough to get a lot of quotes so my post is going to be more of a summary.

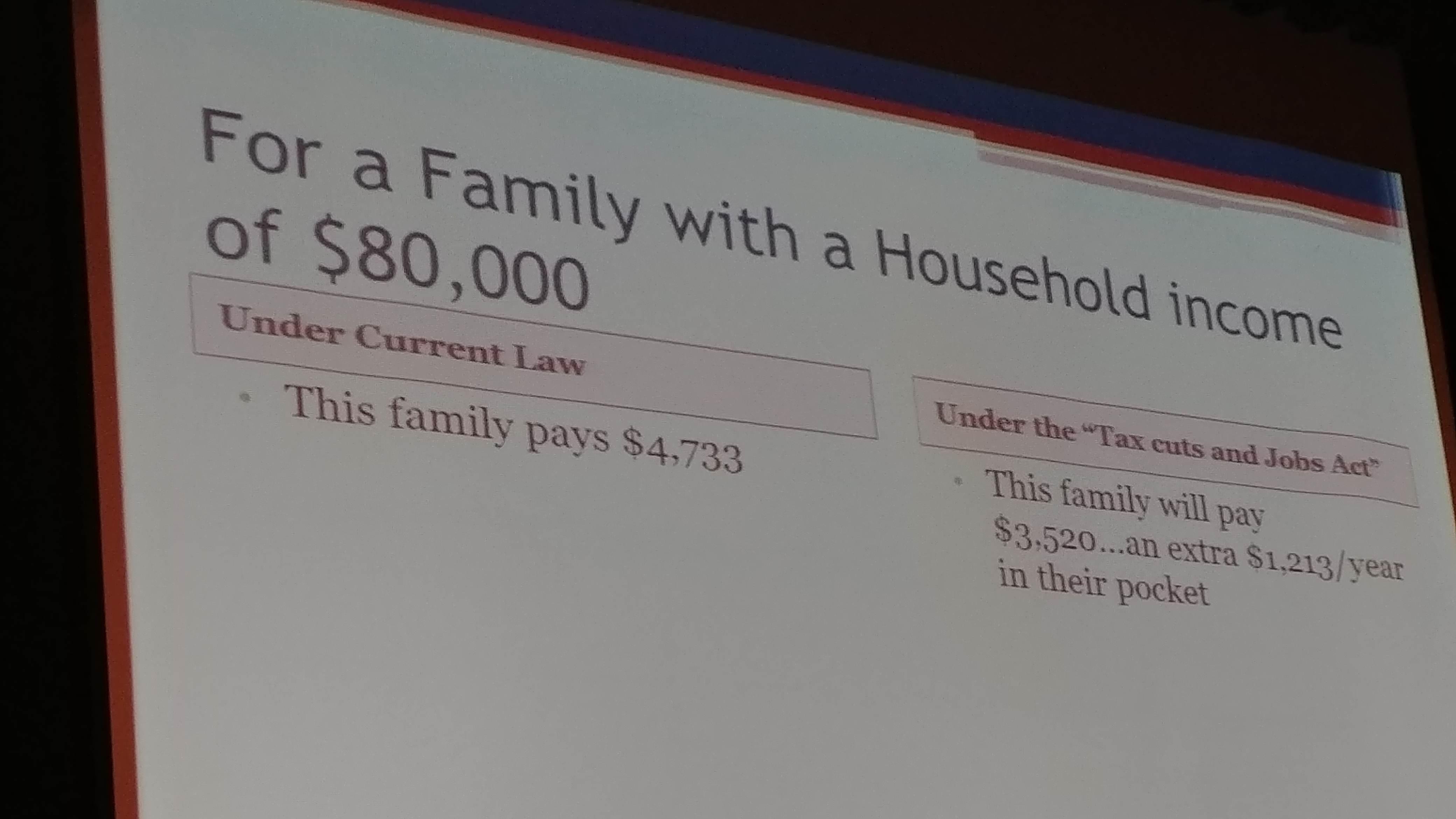

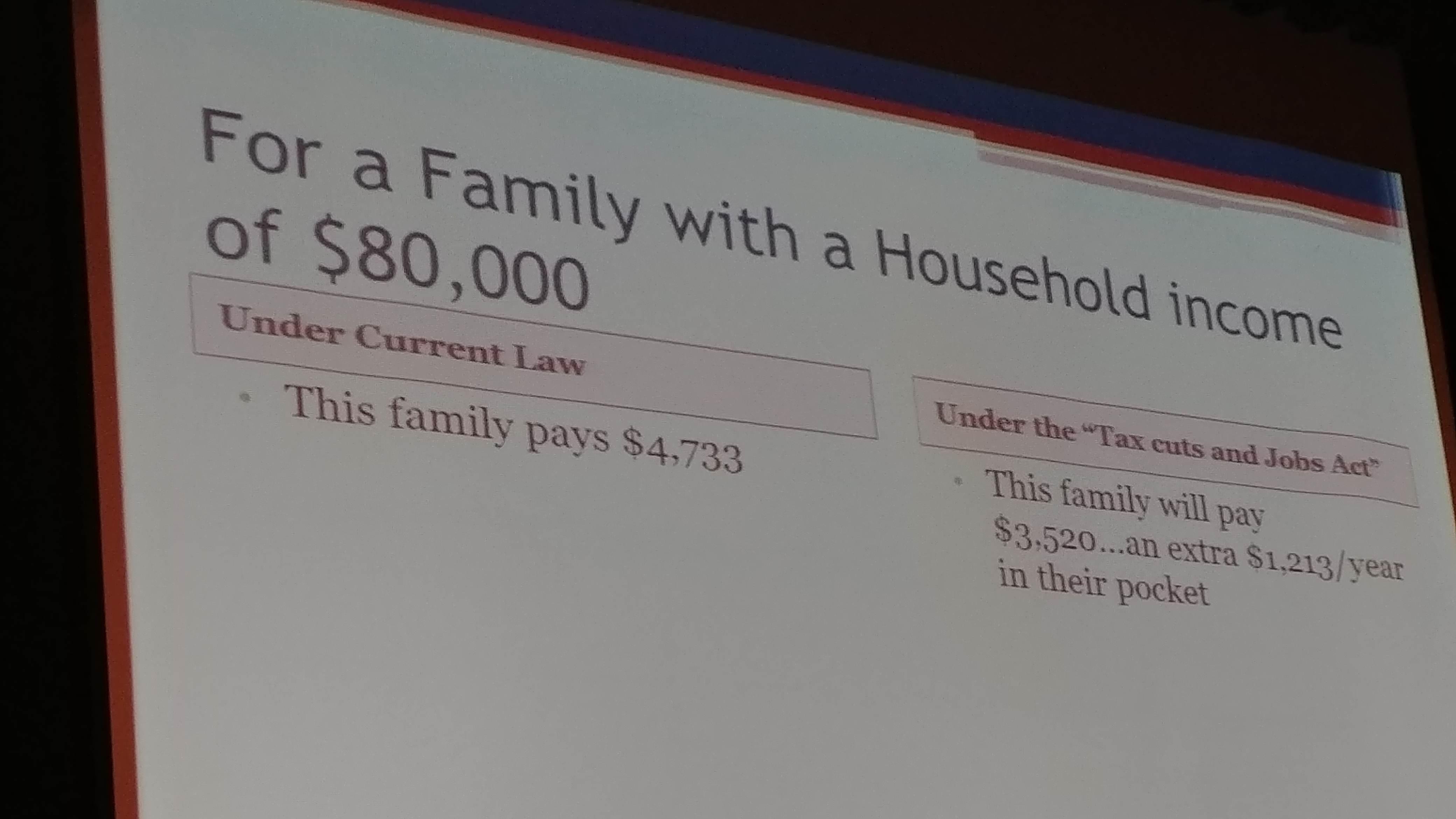

I can say that Harris said the “vast majority” of the middle class would get tax cuts, and that was President Trump’s aim – to have them “targeted to middle income.” This was one of the few slides he showed.

He added that there were now competing House and Senate versions of the bill, with key differences: for example, the Senate bill has the adoption tax credit the House bill lacks, but the House has the $10,000 real estate tax deduction where the Senate bill still has the full elimination of state and local tax deductions. “We know they are areas of concern,” said Harris. Another area he worried about was losing the deduction for medical expenses, which he believed “we should retain.” He noted, too, that “my office door has been knocked down by special interests” who want to keep a particular deduction or credit intact. Later, he warned us this was the “first part of a very long process,” predicting nothing will be final until next spring at the earliest. (Remember, Trump wanted it for Christmas.)

Andy also contended that passing business tax reform would help to increase wages, which would increase productivity. That assertion was ridiculed, of course, although it would be interesting to know just how many of those objecting actually ran businesses and signed the front of paychecks.

At one point Andy was asked about the $1.5 trillion deficit figure that’s been bandied about by the Left in reaction to the GOP tax package, to which Harris asked the folks who applauded the question whether they applauded the $1.3 trillion in deficits Barack Obama ran up in his first year in office. (I thought I heard someone behind me say something along the lines of “but that did more good,” and I had to stifle a laugh.) Essentially, that $1.5 trillion figure assumes no economic benefit from tax reform, said Harris. That echoed his one concern about passage: “We need the economy growing now.”

And, yes, trickle-down does work, Andy added, and no, George W. Bush did not do trickle-down with his tax cuts because they were only for individuals, not businesses. We have had a stagnant corporate tax rate since the 1980s while the rest of the world went down. “If we don’t give relief to American corporations they will go offshore,” said Harris. (In one respect, the “progressives” are right on this one: Harris left out the salient point that corporations are over-regulated, too.)

Over the years, Andy continued later, he’s found out that Washington cannot or will not control spending, so they have to grow the economy to achieve the balanced budget he’s working toward. (Tax cuts have worked before – ask Coolidge, Kennedy, and Reagan.)

Toward the end, someone else brought up the estate tax, which Andy naturally opposes and these “progressive” folks, like the good Marxists they are, reflexively favor. Andy pointed out the examples of family farms and small businesses that work to avoid the estate tax that the opposition claims won’t affect them, but then Andy cited the example of a car dealer who spends $150,000 a year to avoid estate taxes. Someone had the audacity to shout out, “see, he’s helping the economy!” I really wish I had the microphone because I would have asked her: how much value is really created with that $150,000? If there were no estate tax the dealer could have used that to improve his business, hire a couple employees, or whatever he wanted.

Now for some of the other topics. First was a question on net neutrality. The crowd seemed to favor government regulation but Harris preferred to “leave the internet to prosper on its own.” (A lot of mumbling about Comcast was heard after that one.)

This one should have been a slam dunk, but even it was mixed. Harris pledged to allow people to keep and bear arms for whatever reason they wanted, and when some in the crowd loudly objected Andy reminded them his parents grew up in a communist country where the people had no guns but the government did. That doesn’t usually end well.

And after the recent Sutherland Springs church massacre, there was a question about the federal gun purchase form (Form 4473, as I found), because the shooter had deliberately omitted information on a conviction. Harris pointed out that he had asked then-AG Eric Holder that very question about how many people he had charged with lying to the government on that form and he said 10, because he had higher priority items. Okay, then.

There was a question asked that I didn’t really catch about the student savings program being extended to the unborn, and before Andy got real far into his answer someone behind me got in a way about this being a trick to “establish personhood” for the unborn. I thought they already were. This actually relates to a question asked later about the Johnson Amendment, which is generally interpreted as a prohibition on political activity from the pulpit so churches maintain their tax-exempt status. Harris called the Johnson Amendment “ridiculous,” opining that a church should be able to tell its parishioners which candidates have similar political views without fear of the IRS – much to the chagrin of the traveling roadshow.

This one was maybe my favorite. A questioner asked about a lack of women in leadership positions under Trump, but when that questioner was asked about Betsy DeVos – a woman in a leadership position as Secretary of Education – well, that didn’t count. “This President is going to appoint people who do the job,” said Harris. (Speaking of women seeking leadership positions, among those attending was state Comptroller candidate Angie Phukan. She was the lucky monocle returner.)

There was another questioner who asked if anything was being done in a bipartisan manner, to which Harris pointed out the House cleared a number last week. “Watch the bipartisan bills being passed on Monday,” said Harris.

Since I had time to kill before the event, I wrote a total of four questions to ask and it turned out three made the cut. Here were the three and a summary of the answers.

What are the factors holding back true tax reform? Is it a fear of a lack of revenue or the temptation of government control of behavior that stops a real change to the system?

The biggest factor Andy cited was the K Street lobbyists, which I would feel answers the second part of the question better than the first, Note that he had said earlier special interests were beating down his office door. He also said he would really prefer a flat tax.

We have tried the stick of forcing people to buy health insurance through Obamacare and it didn’t do much to address the situation. What can we do on the incentive side to address issues of cost control and a lack of access to health care?

For this question, Andy gave the state-level example of the former Maryland state-run health insurance program, which acted as an insurer of last resort. And when someone yelled out, “it went bankrupt!” Andy reminded her that the program was profitable until Martin O’Malley raided it to balance a budget. Then there was some shouting fit over how bad the program was from someone who was a social worker, but then could you not have that same issue with the Medicare for All these people want (and Andy says “is not going to work”)? After all, both were/are government programs.

On that same subject, Andy said the American Health Care Act that died in the Senate “would have been good for Maryland” if it had passed.

The recent election results would tend to suggest President Trump is unpopular among a certain segment of voters. Yet the other side won simply because they ran against President Trump, not because they presented an agenda. What agenda should the GOP pursue to benefit our nation going forward?

This one had a short, simple answer I can borrow from a Democrat: it’s the economy, stupid. Get tax cuts passed so we can keep this accelerating economy going.

Lastly, I get the feeling I’m going to be semi-famous.

Given the fact that probably half the audience was rabid left-wing and/or open supporters of at least one of his Democrat opponents were there, I’m thinking the camera belongs to them. So if you stumble across any of the video, I’m the guy sporting the Faith Baptist colors up front.

Seriously, I was shocked at the lack of a media presence there. I gathered the Daily Times was there and they will spin it into more proof that Harris is unpopular. Maybe the Independent, the Sun, and the WaPo were too. But don’t let it be said that Harris was afraid to face his opposition. “This (townhall) is what America is all about,” said Andy near the end.

Personally, I get the frustration some on the Left feel about being in this district since we on the Right feel that way about the state. There was actually a question about gerrymandering asked, and while Andy properly pointed out it’s a state-level issue he also added that Governor Hogan has attempted to address this without success. They may also be frustrated because I know there were at least a couple cards in the hopper trying to bait Andy into answering on the Roy Moore situation, which Andy already addressed.

Overall, now that I’ve experienced the phenomenon for myself, it seems to me that our friends on the Left can complain all they want about their Congressman not listening. But every one of us there had the right to ask questions and common courtesy would dictate that we get to hear the answers whether you like them or not. So maybe you need to listen too.

Oh, and one other question for my local friends on the Left: are you going to clamor for Senators Cardin and Van Hollen to have a town hall here like you did for Harris? I know I would like one.