We all knew it was coming, the question was how long it would take to become a reality. The misnamed “Employee Free Choice Act of 2009” was introduced earlier this week. And my only surprise at H.R. 1409 is that Frank Kratovil’s name isn’t on it as a co-sponsor (at least not yet. The unions do have to get what they paid for last year.)

In a nutshell, what EFCA2009 provides is the opportunity for unions to twist the arms of workers so they sign a card claiming their support for a union shop. Once the union gets 50% plus 1 of the eligible employees the union is allowed in. For their part, the unions claim that management attempts the same sort of dirty tricks but in neither case should a secret ballot be influenced. Apparently unions want to reduce their chances of losing since they only win these elections about 2/3 of the time.

Because the bill has 222 co-sponsors, there’s little chance of it being stopped in the House – in truth, there’s little chance Frank Kratovil will be strongarmed into going into the record as voting for it unless there’s a procedural need to do so. Certainly he knows that the First District would probably rather see good right-to-work legislation than live by the EFCA2009.

Where this bill may be killed is in the Senate – that is if the GOP sticks together and sells its case to the American people. In all honesty we’re probably not ever going to get a significant portion of the hardcore union vote anyway so there’s little to lose by stopping H.R. 1409 dead in its tracks.

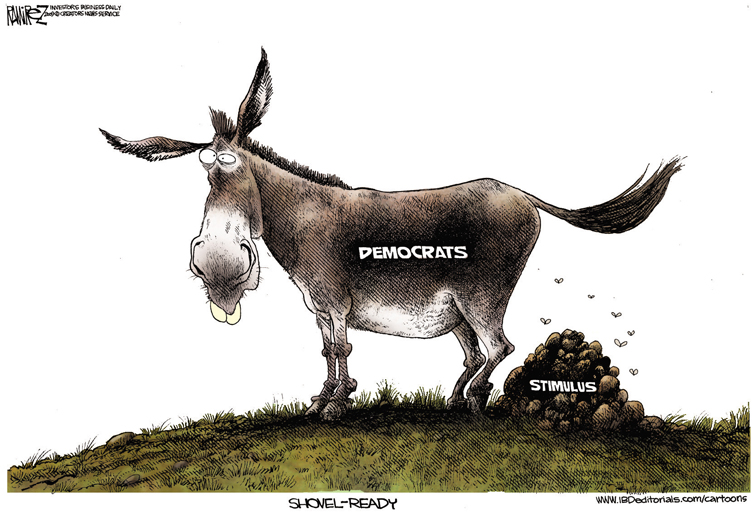

On the other hand, by allowing the plunder of small businesses by union locals thirsty for new sources of revenue from the dues they collect (much of which is immediately funneled into the coffers of the Democrats) the GOP puts itself at a severe monetary disadvantage by not stopping this bill. With President Obama already overturning a number of business-friendly provisions enacted under the Bush Administration there’s little doubt that EFCA2009 is yet another payback to Big Labor – one that could yield an even greater dividend than bailing out the United Auto Workers provided.

The group Americans for Job Security has set up a Facebook site to oppose the EFCA2009 initiative, and I encourage those Facebook members who believe that a worker’s right to a secret ballot should remain in place to join. Otherwise you may arrive at work one day to find Guido and Lefty waiting at the time clock with a paper for you to sign.