Last year I did a five-part series that studied the legacy of Orioles general manager Dan Duquette. You have likely figured out I’m a baseball fan, and although my big league team of choice is my home region’s Detroit Tigers I follow the Orioles as well because that’s where a lot of my Delmarva Shorebirds end up – if Duquette doesn’t trade them away. At the end of last season fans were bitterly frustrated that the Orioles couldn’t get past the wild card game, and this season they really fumed as players they dealt away for guys who never panned out or simply dismissed in cash deals succeeded for other teams.

So I decided to go ahead after this season’s debacle and follow up on this series, which uses the statistic of Wins Above Replacement (WAR) as a way to compare player worth. (Of course, cash has no player worth.) But I have also added a new wrinkle in that I went through the Baseball America archives to find all the minor league deals Duquette completed as well, creating a spreadsheet of all the deals and who’s still involved – players involved in trades can make deals live on if they are traded again by the new team, and this has happened a few times.

But thanks to catcher Gabriel Lino signing a minor league pact with the Cardinals last offseason, I could close the book on the entire 2012 Duquette season. Lino was the last remaining piece the Phillies received when they sent us Jim Thome for the playoff push, and in four subsequent seasons Lino bounced around the Phillies’ system without making the big club.

2012 was, as you may expect, a winning year for Dan, but not overwhelmingly so: his nine deals netted a total of 5.1 WAR while the players he gave up realized a cumulative (-1.3) WAR for their teams. Oddly enough, in strictly WAR terms Duquette’s worst trade was his very first as he acquired backup catcher Taylor Teagarden for two minor leaguers, Randy Henry and Greg Miclat. Neither Henry nor Miclat ever made the Show, but Teagarden had a (-0.6) WAR in two sparsely-used Oriole seasons before leaving as a free agent after the 2013 season.

The best deal he made paid dividends for awhile: acquiring pitchers Jason Hammel and Matt Lindstrom from the Rockies for “ace” Jeremy Guthrie. Hammel provided 3 Wins Above Replacement in two seasons before leaving, while Lindstrom (0.7 WAR) was the bait to later bring in Arizona pitcher Joe Saunders (0.8 WAR as a 2012 rental.) That total of 4.5 WAR was most of Dan’s seasonal success; meanwhile, not only did the Rockies strike out with Guthrie’s (-0.7) WAR as a member of the Rockies, they flipped him to the Royals for Jonathan Sanchez and another (-0.5) WAR. That accounted for most of the overall failure among all teams. (Guthrie was far more successful with Kansas City, so the Rockies were really burned.)

I can’t close the book quite yet on 2013, although a significant part of the Duquette nightmare may soon stop haunting him. If, as most experts expect, Jake Arrieta decides to move on from the Cubs as a prized free agent, that meter of 21.3 WAR he’s accrued with them will stop running. While that’s by far the worst offense of the 29.3 WAR that Duquette gave up (compared to receiving just 2.4 WAR in a staggering 21 deals, mostly on a minor league level) there are still a number of players who are working both for and against him as a result.

The Arrieta deal also included relief pitcher Pedro Strop, who has put up 5.4 WAR of his own and remains Cubs property. Also working against Duquette is a player he could not have known about, but one who will be sporting a World Series ring. As part of the trade with Houston that brought pitcher Bud Norris, the Orioles sent the Astros their “Competitive Balance” draft pick, and the Astros used it in the 2014 Draft to select outfielder Derek Fisher and his 0.4 WAR as a raw rookie this season. Also adding 0.7 WAR to that total against Duquette is Astros pitcher Mike Fiers, who was originally the property of the Milwaukee Brewers but came to Houston with another since-released player in a trade where the Brewers received (among others) then-minor league pitcher Josh Hader, who was also part of the Norris deal. (1)

So if you assume all these players except Arrieta stay put, this will leave the Cubs’ Strop and the Astros’ Fiers and Fisher as active remnants of 2013 trades against Duquette. But Dan has three on his side as well.

In the Arrieta trade, Dan picked up the Pride of Pigtown, Steve Clevenger. While Steve only had a 0.3 WAR with Baltimore, his best asset was being part of the trade with Seattle to bring Mark Trumbo. Barring a trade, they will have two more seasons of Mark to add value to the 1.1 WAR he’s already brought on. (The best way to do so: play him strictly as a DH because his defensive WAR is horribly negative.)

A much lesser known trade is the other wildcard. In early 2013 the Orioles unloaded veteran pitcher Luis Ayala to Atlanta and got a minor league pitcher back in Chris Jones. There was a little talk about Jones as a prospect, but three fruitless seasons later he was shipped to the Angels for two minor leaguers, outfielder Natanael Delgado and infielder Erick Salcedo. Delgado was a fringe prospect who last played with Delmarva and missed all of 2017 with an injury, but Salcedo has moved up the system to Bowie. (2)

When your most successful trade in terms of net WAR comes because the player you got never left Norfolk (Trayvon Robinson) but the guy you gave up was brutal – Robert Andino and a (-0.3) WAR in a few months with Seattle – that’s a year worth forgetting.

Analyzing the 2014 season is much simpler: just 11 trades, which Duquette has won by so far a count of 8.4 WAR to 2.6 WAR.

Perhaps the best trade of the Duquette era was the one that brought Brad Brach (6.4 WAR and counting) from San Diego for a minor league pitcher who returned here a season later to retire, Devin Jones. Devin never got past AA, but Brach piles on the WAR.

The only player remaining against Duquette from his deals that season is from the second-most reviled deal behind Arrieta – the trade with Boston where rental pitcher Andrew Miller came in exchange for Eduardo Rodriguez (4.7 WAR). Unless Rodriguez has a long Boston career, though, 2014 looks like it may be Duquette’s best showing as these trades were his best and worst, respectively.

2015 was another step backward for Duquette. It seems sometimes that the more trades he makes, the bigger hole he digs, and this was the case here. In the case of the 2015 season, 11 of the 16 deals were cash transactions one way or the other, including a new and unique transaction where pitcher Chris Lee was acquired from Houston for two international bonus slots, assigned piles of money granted by Major League Baseball for teams to use to sign international talent (or deal away, as the Orioles did.) Lee is still in the Orioles organization so this is a trade which could pan out (there’s really no way of knowing who Houston acquired with their money), but by and large most of these trades were made to bolster the minor leagues. Six of the eleven cash deals closed out with no WAR acquired as the player never made the big leagues.

As the time period is more recent, several of these deals are still open and the Orioles have a combined 0.3 WAR on their side against 10.0 WAR for their opponents. The bad news is that the prospects for improvement on Baltimore’s side are relatively slim, and could decline further as three players in question – catchers Chris O’Brien and Audry Perez (neither of whom have played for the Orioles) and pitcher Richard Rodriguez [lit up for a (-0.3) WAR this season] are all minor league free agents. (3) Besides the aforementioned Lee, the only player who could add value to Baltimore is pitcher Daniel Rodriguez, who has been loaned to the Mexican League for the last three seasons.

On the other hand, the list of players Duquette parted with (and were acquired in subsequent trades by the new teams) may give fans even more heartburn in coming seasons. In order of their departure, they include Stephen Tarpley, a pitcher who the Pirates later flipped to the Yankees for pitcher Ivan Nova (3.5 WAR) and pitcher Steven Brault and his (-0.3) WAR for Pittsburgh. Tarpley and Brault were the price for the Travis Snider (1 WAR) outfield experiment that lasted less than a season.

Another player who has a chance to hurt the Orioles someday is a minor league pitcher for the Dodgers named Josh Sborz – yet another “Competitive Balance” draft pick Duquette dealt away for 2015 (in this case for Chris O’Brien and another departed player.)

When once again the best trade you make is offloading a player [in this case, infielder Steve Lombardozzi and (-0.3) WAR to the Pirates for cash] you know it’s a bad year. The worst trade from 2015 could get a whole lot more bad before it’s finished as the long-departed rental outfielder from Milwaukee Gerardo Parra [(-1.1) WAR] cost the Orioles promising pitcher Zach Davies (6 WAR and counting – he’s under team control until 2022.) It could be another Arrieta in the making.

A more subdued Duquette limited the damage in 2016, making only 13 trades and just 4 for cash. He also picked up pitcher Edgar Olmos from the Cubs for nothing – originally this was for a player to be named later, but no one was ever named. Olmos filled a minor league slot for a season before leaving.

Surprisingly few players are still active from the 2016 deals. I told you earlier about Mark Trumbo, who is adding to the 2016 composite WAR of 0.3, as well as Natanael Delgado and Erick Salcedo. The other player who could have added to the Orioles meager total is minor league pitcher Brandon Barker, who the Orioles received as part of a salary (pitcher Brian Matusz) and 2016 “Competitive Balance” draft choice (minor league catcher Brett Cumberland, who is still active) dump deal with the Braves. (4) Cumberland could add to the 2.0 WAR so far compiled by opponents, but it’s more likely short-term that pitcher Ariel Miranda [1.8 WAR, sent to Seattle for pitcher Wade Miley and his (-0.6) WAR] will stockpile Wins Above Replacement. Others who could haunt the Orioles are farmhand pitcher Jean Cosme [sent to San Diego for pitcher Odrisamer Despaigne (-0.2) WAR before being waived at the tail end of 2016] and a rental of utility man and repeat Oriole Steve Pearce (0.1 WAR) that netted Tampa Bay minor league catcher Jonah Heim. (5)

So going forward it’s Trumbo, Delgado, Salcedo, and Barker against Cumberland, Miranda, Cosme, and Heim. Only two of them are currently in the bigs, so the totals may not move much in future seasons.

Adding up the first five seasons of Duquette’s legacy, he’s accrued a total WAR of 16.5, or about 3.3 per season. However, opponents have collectively gained a total of 42.6 WAR – roughly 8.5 per season.

This brings us to 2017, which was an extremely busy season for Duquette because he had a new weapon at his disposal.

Where teams could previously only trade international bonus slots, changes to the rules eliminated the slots and created a free pool of money teams could parcel out as they wished – and Duquette really wished! Eight different minor league players were acquired with the international bonus pool cash, and eight others were standard cash deals. I’ll pick up where I left off last season.

- Trade 42 (November 30, 2016) – Orioles purchase the contract of P Logan Verrett from New York Mets.

The Orioles tried to get Verrett before as a Rule 5 pick in 2014 but ended up waiving him, losing him to the Texas Rangers before they returned him to the Mets a month into the season. When the Mets signed Yoenis Cespedes as a free agent, it made Verrett available and Baltimore jumped at the chance. But Verrett only made four appearances for the Orioles, compiling no WAR before being outrighted in September and allowed to become a free agent at season’s end and signed with the NC Dinos of the Korean Baseball Organization.

- Trade 43 (January 6, 2017) – Orioles trade P Yovani Gallardo and cash to Seattle Mariners for OF Seth Smith.

In an effort to shore up their outfield, the Orioles traded from what they thought was their strength as Gallardo was a sixth member of what was figured to be a five-man rotation of Tillman, Gausman, Bundy, Miley, and Jimenez. Instead, Smith (0.3 WAR) became a fourth outfielder with the ascension of Trey Mancini and figures to leave as a free agent. Gallardo, though, was even worse for Seattle as he put up a (-0.1) WAR and then signed as free agent with the Milwaukee Brewers.

- Trade 44 (February 9, 2017) – Orioles trade minor league P Ryan Moseley to Los Angeles Dodgers for P Vidal Nuno.

Moseley spent the season in the low reaches of the Dodgers’ system, while Nuno made 12 relatively brutal appearances for the Orioles for a (-0.5) WAR. Outrighted in August, Nuno elected free agency at season’s end and was one of the first to sign elsewhere, inking a deal with the Rays.

- Trade 45 (February 10, 2017) – Orioles purchase the contract of P Gabriel Ynoa from New York Mets.

A solid acquisition so far as Ynoa gave the Orioles a WAR of 0.5 in nine appearances and is under team control for several seasons to come. He’s being discussed as a rotation candidate for 2018.

- Trade 46 (February 21, 2017) – Orioles trade cash or a player to be named later to New York Yankees for P Richard Bleier.

This turned out to be one of the best trades Duquette made in terms of net WAR as Bleier put up a 1.3 WAR for the season for cash. Again, Duquette snagged a controllable piece of his bullpen for very little cost after the Yankees designated him for assignment a few days earlier.

- Trade 47 (March 28, 2017) – Orioles trade cash or a player to be named later to Philadelphia Phillies for P Alec Asher.

Asher fits the profile of the other pitchers acquired in this time period – controllable with a lot of potential and coming at little risk. He wasn’t as successful as the others since he put up a 0.0 WAR in 24 appearances for the Orioles.

- Trade 48 (April 6, 2017) – Orioles purchase the contract of P Andrew Faulkner from Texas Rangers.

Faulkner, who spent parts of the previous two seasons with Texas, didn’t make it to the Orioles and was outrighted to the minors at season’s end, becoming a free agent shortly afterward. However, he opted to stay within the Orioles’ fold.

- Trade 49 (April 7, 2017) – Orioles acquire P Miguel Castro from Colorado Rockies for player to be named later. Minor league P Jon Keller was sent to Rockies to complete the trade on September 7.

Another refugee of being designated for assignment by his former team, Castro was a prized member of the Orioles bullpen during the season, making 39 appearances and compiling a 0.9 WAR. He has five seasons of team control left. Keller was once a prospect mentioned frequently by Orioles’ brass but he’s had back-to-back poor seasons and may have needed a change of scenery.

- Trade 50 (April 10, 2017) – Orioles trade minor league P Joe Gunkel to Los Angeles Dodgers for cash.

This trade is noteworthy because it closed the book on a trade from 2015 (Trade 29) that sent Alejandro De Aza to Boston. Gunkel, who had been designated for assignment three days earlier, once was thought to have a chance to make the Orioles’ staff, but he never grabbed the brass ring. So that trade went down as a loss. As for the Dodgers, they tried to sneak Gunkel through waivers 2 1/2 weeks later but lost him to Miami, where he finished the season with a demotion to AA Jacksonville.

- Trade 51 (April 13, 2017) – Orioles trade international bonus pool cash to Milwaukee Brewers for P Damian Magnifico.

The first of several trades involving the Orioles’ bonus pool, Magnifico (another DFA) didn’t stay long in the Orioles’ minor league system as you’ll see.

- Trade 52 (April 14, 2017) – Orioles trade international bonus pool cash to Seattle Mariners for minor league P Paul Fry.

Fry managed to spend two days in April on the Orioles’ active roster but still awaits his major league debut. If you haven’t noticed a pattern, Fry was also a DFA by the Mariners. Dan Duquette was becoming adept at scouring the waiver wire.

- Trade 53 (April 14, 2017) – Orioles trade P Oliver Drake to Milwaukee Brewers for cash.

Having designated Drake for assignment the day before, the Orioles got what they could for the longtime farmhand who worked his way up the system. Drake turned out to be a nice pickup for Milwaukee as he chipped in 0.2 WAR for them as a setup man.

- Trade 54 (April 17, 2017) – Orioles trade P Parker Bridwell to Los Angeles Angels for cash.

Another player Dan Duquette had to DFA, shipping Bridwell off turned out to be the worst trade Duquette made as Bridwell came up with a WAR of 2.0 in part of a season.

- Trade 55 (May 4, 2017) – Orioles purchase the contract of minor league C Armando Araiza from Atlanta Braves.

After making 13 trades in a row involving pitching, Dan worked on the other side of the battery in this minor league deal. Araiza spent most of his season with Frederick but also stopped with Bowie and Norfolk.

- Trade 56 (May 6, 2017) – Orioles trade P Damian Magnifico to Los Angeles Angels for minor league P Jordan Kipper.

It turned out that Magnifico made one appearance for the Angels and put no WAR up, while Kipper started out with Norfolk and was demoted to Bowie.

- Trade 57 (May 20, 2017) – Orioles trade international bonus pool cash to Chicago White Sox for minor league P Alex Katz.

Katz spent the remaining season in Frederick, which was a promotion from where the White Sox had him – but the results were pedestrian at best.

- Trade 58 (June 4, 2017) – Orioles purchase the contract of IF Ruben Tejada from the New York Yankees.

Looking for a backup infielder with experience, the acquisition came in handy for a time when J.J. Hardy broke his wrist a couple weeks later. But Tejada wasn’t the answer, putting up a WAR of 0.0 and eventually being outrighted in August. He was granted free agency in October but also opted to stay put.

- Trade 59 (July 2, 2017) – Orioles trade international bonus pool cash to New York Yankees for minor league P Matt Wotherspoon.

Matt simply switched International League franchises in the deal and put up reasonably good numbers for Norfolk. With another couple seasons to go before he hits minor league free agency, he has an outside chance of making it to the Orioles’ bullpen in the next season or two as a late bloomer.

- Trade 60 (July 2, 2017) – Orioles trade international bonus pool cash to Los Angeles Dodgers for P Jason Wheeler.

For Wheeler this was his second cash deal in less than a month as the Dodgers had similarly acquired him from the Twins, for whom he had debuted and made 2 appearances in May. The Dodgers had already outrighted Jason to AAA, so the Orioles made a modest enough offer to them to take Wheeler off their hands. For the Orioles he never left Norfolk and was granted free agency in October, signing with the KBO Hanwha Eagles.

- Trade 61 (July 5, 2017) – Orioles trade international bonus pool cash to New York Mets for minor league IF Milton Ramos.

Local fans are quite familiar with this deal because Ramos went from the SAL’s Columbia Fireflies (who had played here in May) to the Shorebirds. While Milton was a top-30 prospect with the Mets his stock had fallen off in the previous year, making him expendable and perhaps in need of a scenery change. If this ever accrues to the Orioles’ side of the ledger it won’t likely be before the start of the next decade.

- Trade 62 (July 7, 2017) – Orioles trade international bonus pool cash to Milwaukee Brewers for minor league P Aaron Myers.

Another trade to help the Shorebirds, Myers was effective here albeit in limited time due to injuries. Like Ramos, it’s at least two to three seasons before Myers would even be considered big league help so this was another trade to bolster a weak area of the organization.

- Trade 63 (July 29, 2017) – Orioles trade OF Hyun-Soo Kim, minor league P Garrett Cleavinger, and international bonus pool cash to Philadelphia Phillies for P Jeremy Hellickson and cash.

This was a trade that attempted to send a message that the Orioles weren’t sellers. Because Trey Mancini had taken so well to the outfield and Kim was never proven against left-handed pitching, the Korean import was glued to the bench. Moving to Philadelphia wasn’t a favor to Kim in that regard as he had a (-0.9) WAR and became a free agent, having completed his initial two-year pact coming over from Korea. (In December he signed a deal to return there.) Cleavinger moved laterally at the AA level but wasn’t very good; however, he has a decent track record to build from and will likely be the last piece standing from this deal. Hellickson bombed with the Orioles as he also put up a (-0.9) WAR and is also a free agent.

- Trade 64 (July 31, 2017) – Orioles purchase the contract of minor league P Yefry Ramirez from New York Yankees.

Originally an infielder in the Diamondbacks’ system, a position conversion and different organization saw Ramirez rocket from rookie league at the end of 2015 to AA to begin 2017. There are some who believe he may be a possible September callup in 2018, if not sooner, as their successful pilfering of the Yankee treasure trove of minor league pitching continues.

- Trade 65 (July 31, 2017) – Orioles trade minor league P Tobias Myers to Tampa Bay Rays for IF Tim Beckham.

It will be awhile before we know the impact of Myers, who was traded off the short-season Aberdeen roster, but Beckham was an immediate hit after hit for the Orioles and compiled a WAR of 2.0 in just 2 months, making it the best trade Duquette has made to date for 2017. With the departure of J.J. Hardy the shortstop position is now Beckham’s.

- Trade 66 (August 5, 2017) – Orioles trade international bonus pool cash to Texas Rangers for minor league IF Brallan Perez.

Another trade to boost the low minors, Perez moved laterally as he spent most of his season in the Carolina League with either the Rangers’ Down East Wood Ducks affiliate or the Frederick Keys. He had great numbers with Frederick so maybe the change did Perez good.

- Trade 67 (August 9, 2017) – Orioles trade P Steve Johnson to Chicago White Sox for cash.

Johnson, who many fondly remember from his first go-round in the organization – he pitched for the Orioles from 2012-13 and again in 2015 – came back after spending time in the Texas and Seattle organizations but did not escape AAA this season. Once again he will be a free agent this winter – an anti-climactic trade to finish the trading season for Duquette, who so far is winning the WAR war 3.6 to 1.2 thanks to all those cash deals.

And Dan may have hit upon a winning strategy when it comes to his international bonus pool money because the Orioles’ Dominican program is terrible. Why spend thousands of dollars trying to develop two teams’ worth of players who rarely make it past the low minors and haven’t sent a player to the big leagues since 2010? Eduardo Rodriguez is the last DSL Oriole player to make the big leagues and that’s when he pitched there. This season they cut it down to one team and perhaps spent the money saved in selectively acquiring guys who already have a track record or could fill a need. Because the 2015 and 2016 draft classes seem weak in depth (meaning Delmarva and Frederick weren’t very good) Dan shored the teams up with a handful of players from other clubs. They may never make the major leagues but they stand a little better chance than a typical overseas player.

Time will tell whether these trades will pan out, but I think this will turn out to be Duquette’s best year because he doesn’t really have any scary good players out against him (except perhaps the mercurial Parker Bridwell.) Yet if a couple of these sleeper picks turn out to be good or if Beckham is a long-term solution at short, he will have some winners this time to brighten up an otherwise subpar season.

__________________

In rereading this piece as part of my year in review I can provide some updates, as of 12/24/17.

- Mike Fiers signed as a free agent with the Tigers, thus closing out the successor deal to the Bud Norris trade that sent Josh Hader to the Brewers.

- Erick Salcedo was also a minor league free agent, but he resigned with the Orioles.

- Richard Rodriguez has since signed a minor league deal with the Pittsburgh Pirates.

- Brandon Barker was selected away from the Orioles in the minor league portion of the Rule 5 Draft by the Miami Marlins.

- Jonah Heim was traded to the Oakland Athletics to complete an earlier deal for infielder Joey Wendle.

I have been doing music reviews for about 3 1/2 years now and I thought originally this would mark a first: the first time I’ve reviewed the follow-up to one of my #1 albums from a particular year and it had a shot to be back-to-back #1’s. You probably remember that Paul’s last full-length “Diamonds & Demons”

I have been doing music reviews for about 3 1/2 years now and I thought originally this would mark a first: the first time I’ve reviewed the follow-up to one of my #1 albums from a particular year and it had a shot to be back-to-back #1’s. You probably remember that Paul’s last full-length “Diamonds & Demons”

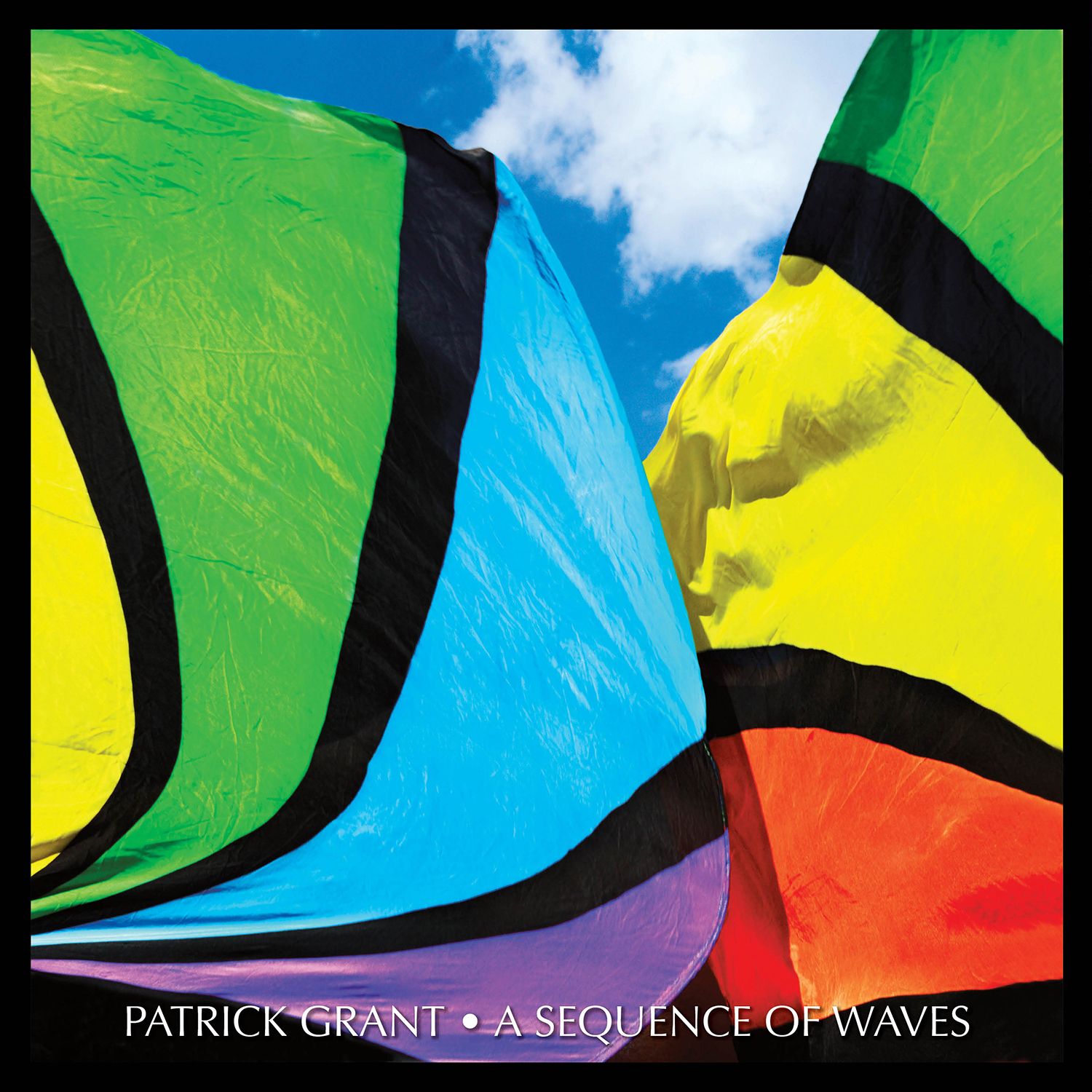

This is one of the more unique selections I’ve come across in recent months because there are so many categories involved, not to mention the fact it’s almost entirely instrumental. But don’t let that scare you.

This is one of the more unique selections I’ve come across in recent months because there are so many categories involved, not to mention the fact it’s almost entirely instrumental. But don’t let that scare you.